Joy of Always Earning an Income

First you work for an education, then you work for money, then people work for you, then money works for you. When money works for you, well, then you are free to save our planet.

Northern Virginia Circa 1987

When my family and I moved to Fairfax, Virginia in 1987, I had a feeling we weren't earning a lot of money. My father was an adjunct professor serving multiple universities and my step-mother was a retail bank manager. 32 years later I spend a small portion of my time as an adjunct instructor at American University and can verify that you don't do it for the pay. And today, they still don't pay bank managers much. Even as a wet-behind-the-ears 13 year old, I knew to bother asking for an allowance of any kind. I figured the best I could do was get some kind of part-time job to earn some money. I soon learned that in Fairfax County you had to be 14 years old and 8 months to get a work permit and I was off by about a year. Without thinking, I made a decision that changed my relationship with earned income forever.

When my family and I moved to Fairfax, Virginia in 1987, I had a feeling we weren't earning a lot of money. My father was an adjunct professor serving multiple universities and my step-mother was a retail bank manager. 32 years later I spend a small portion of my time as an adjunct instructor at American University and can verify that you don't do it for the pay. And today, they still don't pay bank managers much. Even as a wet-behind-the-ears 13 year old, I knew to bother asking for an allowance of any kind. I figured the best I could do was get some kind of part-time job to earn some money. I soon learned that in Fairfax County you had to be 14 years old and 8 months to get a work permit and I was off by about a year. Without thinking, I made a decision that changed my relationship with earned income forever.

One weekend I walked up to my neighbors on Twinbrook Road and started offering lawn care services. Funny thing was, I didn't own any lawn care tools: not a hedger, not a trimmer, not even a lawnmower. What I did have was the determination to exchange my time for money and it turns out that time was indeed worth something to my neighbors. Looking at my old neighborhood all these years (see a Google Maps view here) I'd like to say what I did for those lawns truly was worth something! The truth is I owe a debt of gratitude to my neighbors who taught me a valuable lesson at a formative age: if you are willing to be creative, use your time wisely and offer value, you can always make money. And I did for my neighbors; until I was old enough to get my first real job at Toys R Us.

Today

When working with clients we focus on 7 interrelated financial strategies, most notably, income or earnings. Our focus on earnings - what are clients are making now and could make in the future - is one of the things that  separates Jason Howell Company from other wealth management firms. We believe income should continue past the age that you are willing to go to the office. The idea that income should stop and you should exclusively rely on some accumulated amount of savings for your older years is a myth dreamed up by my industry in the early 1980's just after the 401(k) became commonplace. Before then, you worked until you died and/or you got a pension. Regardless of how you earned it, income was a necessary constant (just as much as it is in your early adulthood). The big reason we were willing to be tricked into the fantasy of a no income retirement is because many wanted to believe in a no-work retirement. A day that would come when work was irrelevant and you could finally have time to yourself. For most of us that's not possible but it doesn't mean you will forever be stuck to a 9 to 5.

separates Jason Howell Company from other wealth management firms. We believe income should continue past the age that you are willing to go to the office. The idea that income should stop and you should exclusively rely on some accumulated amount of savings for your older years is a myth dreamed up by my industry in the early 1980's just after the 401(k) became commonplace. Before then, you worked until you died and/or you got a pension. Regardless of how you earned it, income was a necessary constant (just as much as it is in your early adulthood). The big reason we were willing to be tricked into the fantasy of a no income retirement is because many wanted to believe in a no-work retirement. A day that would come when work was irrelevant and you could finally have time to yourself. For most of us that's not possible but it doesn't mean you will forever be stuck to a 9 to 5.

Opportunity

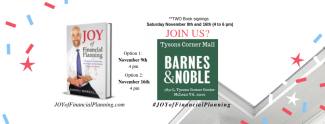

Our generation faces a lot of economic challenges today but we have the opportunity to be entrepreneurial like no other generation before us. Today, you are probably trading time for money; which is a lot better than trading time for nothing (if you are unemployed). In my upcoming book, Joy of Financial Planning, I mention four layers to creating wealth through income.

- First you work for an education i.e. an expertise

- Then you work for money i.e. real money

- Then people work for you i.e. you're paid even more to manage

- Then money works for you i.e. compound growth

Step 1: If you are intentional about your work today, every time you "clock-in" at work, you will add to your expertise, which is an opportunity to be paid more in the future. Employers and clients alike are willing to pay extra for expertise. In a 20, 30 or 40 year career, trade time for an education i.e. an expertise.

Step 2: After you attain your expertise you can either be paid more where you are, at another firm or by starting your own firm. Now instead of making an average income for people in your field, you will make an above average income for a person in your field. This is your chance to work for "real money," i.e. some of which you can set aside.

Step 3: Whether you become a business owner or a rockstar employee, you will eventually run into an opportunity for people to work for you. As a manager, choose the opportunity if you will be paid even more to manage. As a business owner, outsource lower-skilled clerical work so your hourly rate can rise even higher. People working for you will allow you to set aside even more of you income.

Step 4: When you are able to set aside money from Step 3 and Step 4, you will have the opportunity to save and or invest your money as long as you haven't increased your expenses. When your money earns interest that's great. When the interest you've earned, earns interest, that's what Warren Buffet calls the 8th Wonder of the World. I call that your money making money. And the more your money works the less you you have to.

Beginning Today

Steven Covey's 2nd most important habit in his best selling book 7 Habits of Highly Effective People is to "Begin with the end in mind." Whatever you are doing now to earn an income, treat it as training for becoming an expert in your field in 10, 20 or 30 years. Take time to write about your profession and even volunteer for public speaking opportunities. Do those two things and you'll soon be known as an expert. Do those two things for a few years and you'll actually become an expert. You'll be paid more, you'll be promoted and by the time you are ready to leave the 9 to 5, you'll have both saved some money and identified ways to keep the money coming in.

And then you'll be able to change the world, for the good. Thank you in advance for your service.

Jason Howell is a CERTIFIED FINANCIAL PLANNER™ professional, former U.S. Congressional candidate and President of Jason Howell Company. With an emphasis on family wealth and time management, the Jason Howell Company develops parents into future patriarchs and matriarchs. Jason is also the the author of JOY of Financial Planning: 7 Strategies for Transforming your Finances and Reclaiming your American Dream (Release date: Fall 2019).

To book an introductory call, click this link to choose a day/time: Free Consultation