How the *New* Child Tax Credit Works

On May 17, 2021 President Joe Biden announced an advance on their 2021 Child Care Credit which has been increased to $3,600 per child under the age of 6 and $3,000 for each child dependent over the age of 6. Instead of waiting until filing your 2021 tax return, President Biden announced that the annual credit will be paid in monthly installments beginning on July 15th. Since there are only 6 possible months for payments, the balance of your child tax credit will be received upon filing your 2021 tax return.

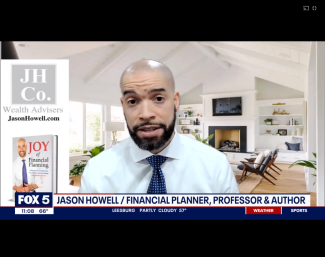

Jason Howell, a friend of local news affiliate FOX5 DC, financial expert and former US Congressional Candidate, was asked to share some commentary regarding the new rules.

<

Jason Howell Company (JHCo.) is an independent, family wealth management firm run by two owners who consider it their family business. Jason J. Howell, CFP®, CPWA®, CSRIC® and Douglas W. Tees, MBA, CFP® are both married to patient wives and are dedicated to their kids.

The firm owners believe that serving families through a process that supports family harmony, preserves family history and nurtures family values is the key to true wealth. It begins with a sustainable Investment Strategy and continues by equipping client families with three (3) tools for creating sustainable wealth. Most JHCo. clients invest their time, talent and treasure in the community. Jason Howell Company enjoys serving clients who go beyond being stockholders to becoming true "stakeholders." JHCo. calls this work total family governance and it's their specialty. Doug and Jason empower communities, one family at a time.

For more information about our strategies, just book an introductory call: Introductory Call