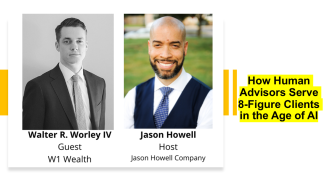

(VIDEO) How Human Advisors Serve 8-Figure Clients in the Age of AI

"We're obsessed with trying to just continue to deliver confident, multigenerational, decision making to grow and preserve wealth."

- Walter R. Worley, IV, CPWA®, CFP®, AIF® President, W1 Wealth

It is not often that we get the opportunity to interview a fellow advanced wealth manager outside of our firm. We met Walter Worley of W1 Wealth in the front row of Jason's presentation at the Fall NAPFA National Conference on "How to Prepare for 8-Figure Clients." When we met then, it was his birthday and he was expecting a large wire for his most recent client's liquidity event (meaning his client sold his business and a large wire transfer was on its way to Walter's firm). That's a big day!

Serving clients with complex financial needs is a special science that requires financial expertise, years of experience and a comfort with personal and family dynamics.

In our discussion, we discuss:

► What he had to do to prepare to serve 8-figure clients?

► What kind of professionals he partners with to serve these families?

► How he sees technology and AI affecting the way he serves clients?

► How he defines success for himself and his clients?

Jason Howell Company is a family wealth management firm that serves ALL family members for ALL things financial. Our specialty is multigenerational wealth planning.

Jason J. Howell, CFP®, CPWA®, CSRIC® and Douglas W. Tees, MBA, CFP® CAP®, CBDA have spent a lot of time in the Washington, DC area, and are aware that many people who are first generation wealth suffer from a kind of "financial imposter syndrome." Successful entrepreneurs and family businesses are always looking over their shoulder; government contractors worry about the next contract; former Capitol Hill staffers privately wonder if they should "feel bad" for the money they now make. Imposter syndrome is common among people who work for the many corporate headquarters based in this area as well. These feelings get in the way of properly managing family wealth. We empower them to get organized, build a team of advisors and make decisions.

Our typical "first generation wealth" families include dual income parents who work, save and have just the right amount of fun. For long-time, family owned businesses we focus on much family preservation as we do wealth preservation.

First generation wealth success stories and family business owners realize that they:

- Need to “do something” with the cash in their checking/savings

- Need to eventually diversify their portfolio away from the family business

- Need an investment strategy for “up” and “down” markets

- Need a plan to mitigate market, credit, inflation, and political risks

- Need to start tax planning instead of just tax paying

- Need to be sure they are choosing the right work benefits

- Need to reduce financial miscommunications between family members

- Need to separate business finances from personal finances

- Need to separate family wealth from individual wealth

- Need a plan to provide space for both family and individual philanthropy

- Need to plan for money while alive and for what happens after death

To learn more about our unique offering, contact us for a complimentary initial strategy session: click here.