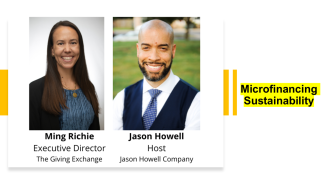

Microfinancing Sustainability (VIDEO)

"Get involved. And if it's not with money, then with time. And I just encourage everyone to do something. 'It feels good and it's beneficial to so many people other than you. And I think we need more of that in our world. Find someone in your community or in your sphere of interest and just continue to give because I think it's the best feeling in the world and we could all use a little more of it."

- Ming Richie, Executive Director, The Giving Exchange

Ming Richie has that bold confidence of someone who has "been there." She has worked in service of corporate America at convention halls in Las Vegas and across the country. She has smiled at corporate executives and taken out the trash (likely at the Bellagio). Along the way Ms. Richie found meaning in a small but mighty non-profit startup called "The Giving Exchange (TGE)."

In our interview, we discuss Ms. Richie's journey from volunteer to international executive leadership; all without ever wearing a watch. TGE started as a passion project by founder and entrepreneur and now TGE board chairman, Rod Mickels. From their website:

"The eye never forgets what the heart has seen."

- African Proverb

For Rod Mickels, this proverb couldn’t be truer. From the moment he first set foot in Kenya in 2001, he felt an immediate connection with the land and the people. He was visiting his daughter Alissa, who was working for Youth with a Mission in Mombasa at the time, when she introduced him to Winnie and the kids in the community. He never forgot them—they touched his heart, and he vowed that he would be back one day.

We were intrigued with the TGE story of entrepreneurship that is taking Mr. Mickels' business success and spreading it throughout the continent of Africa; through vocational skills, animal rearing and farming. The following discussion focuses on how entrepreneurial sustainability is making things happen through intentional, measured microfinancing. Learn how:

- Giving loans and (business) seed money can be > just giving handouts

- Solving long-term needs eventually helps with solving immediate needs

- How TGE is increasing startup success rates from 50% to 80%!

If you get really interested in learning more about TGE, consider asking Ms. Richie (Ming@TheGivingExchange.net) about their 2025 Giving Exchange Gala being held on October 28, 2025.

Jason Howell Company is a family wealth management firm that strengthens the finances of families making the transition from first generation success to family wealth. We envision a world where wealthy families give, grow and govern themselves in ways that enrich their local communities. We do this by reducing the fear, isolation and guilt associated with financial success.

Jason J. Howell, CFP®, CPWA®, CSRIC® and Douglas W. Tees, MBA, CFP® CAP®, CBDA have spent a lot of time in the Washington, DC area, and are aware that many people who are first generation wealth suffer from a kind of "financial imposter syndrome." Successful entrepreneurs and family businesses are always looking over their shoulder; government contractors worry about the next contract; former Capitol Hill staffers privately wonder if they should "feel bad" for the money they now make. Imposter syndrome is common among people who work for the many corporate headquarters based in this area as well. These feelings get in the way of properly managing family wealth. We empower them to get organized, build a team of advisors and make decisions.

Our typical "first generation wealth" families include dual income parents who work, save and have just the right amount of fun. For long-time, family owned businesses we focus on much family preservation as we do wealth preservation.

First generation wealth success stories and family business owners realize that they:

- Need to “do something” with the cash in their checking/savings

- Need to eventually diversify their portfolio away from the family business

- Need an investment strategy for “up” and “down” markets

- Need a plan to mitigate market, credit, inflation, and political risks

- Need to start tax planning instead of just tax paying

- Need to be sure they are choosing the right work benefits

- Need to reduce financial miscommunications between family members

- Need to separate business finances from personal finances

- Need to separate family wealth from individual wealth

- Need a plan to provide space for both family and individual philanthropy

- Need to plan for money while alive and for what happens after death

To learn more about our unique offering, contact us for a complimentary initial strategy session: click here.